- 8 minutes read

Table of contents

For a long period, the crypto-asset market has remained unregulated in the European Union. A group of EU member states has developed cryptocurrency legislation at the national level, but unified rules at the EU level have not been approved yet. To implement a pan-European approach to crypto-assets regulation and avoid legislative fragmentation in the EU member states, on October 10, 2022, the European Parliament Committee on Economic and Monetary Affairs (ECON) settled the approved text for the Regulation of Markets in Crypto-assets (hereinafter MiCA).

The adoption of the MiCA regulation is one of the crucial steps to make Europe fit for the digital age and to build a future-ready economy that works for the people. MiCA regulation would apply between 12 and 18 months after the text comes into force. The final vote on MiCA legislation was recently delayed until February 2023. MiCA will not begin to have effect until early 2024.

Range of MiCA

MiCA applies to natural and legal persons and other undertakings that are engaged in the issuance, offer to the public and admission to trading of crypto-assets or that provide services related to crypto-assets in the EU.

MiCA divides crypto-assets into 3 categories:

- Asset-referenced tokens – a type of crypto-asset that is not an electronic money token and that purports to maintain a stable value by reference to any other value or right or a combination thereof, including one or more official currencies. This includes stablecoins backed by two or more fiat currencies, crypto-backed stablecoins, and commodity-backed stablecoins.

- E-money-tokens – a type of crypto-asset that purports to maintain a stable value by reference to the value of one official currency. This includes stablecoins backed by a single fiat currency.

- Other crypto assets, including utility tokens. A utility token means a type of crypto-asset which is only intended to provide access to a good or a service supplied by the issuer of that token.

It should be noted that MiCA does not apply to crypto-assets that are regulated by existing EU frameworks such as:

- financial instruments governed by Directive 2014/65/ES on financial instruments markets;

- funds (except e-money tokens) governed by Directive No 2015/2366 on payment services in the internal market, deposits;

- deposits governed by Directive 2014/49/EU on deposit guarantee schemes;

- non-life or life insurance products, reinsurance, and retrocession contracts governed by Directive 2009/138/EC on Insurance and Reinsurance, etc.

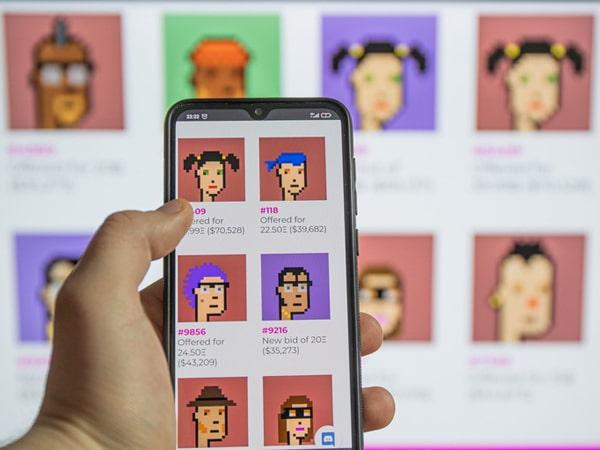

Non-fungible and unique tokens (NFT) are largely excluded from the scope of MiCA, except where ownership is fractionalized. In each case, competent authorities should define a token as non-fungible and unique depending on its de facto features but not its designation by the issuer.

Issuers of crypto-assets other than asset-referenced tokens or e-money tokens

Only a legal person shall offer crypto-assets to the public in the EU. The main condition for the issuers of crypto-assets, other than asset-referenced tokens or e-money tokens, is to draft and publish a crypto-asset white paper. A white paper should be notified to the competent authority 20 working days before its publication. A crypto-asset white paper shall contain the information:

- the offeror or the person seeking admission to trading (and, if different, the issuer and, if relevant, the operator of the trading platform);

- the offer to the public of crypto-assets or their admission to trading on a trading platform

- the crypto-asset and the rights and obligations attached to it;

- the risks relating to the crypto assets;

- the underlying technology used to issue the crypto-asset;

- the principal adverse environmental and climate-related impact of the consensus mechanism used to issue the crypto-asset.

Any marketing communications relating to an offer to the public of crypto-assets, other than asset-referenced tokens or e-money tokens, or the admission of such crypto-assets to trading on a trading platform for crypto-assets, shall be fair, clear, not misleading, and consistent with the information in the crypto-asset white paper.

White paper and marketing communication requirements do not apply to the issuers of crypto-assets, other than asset-referenced tokens or e-money tokens, when:

- an offer addressed to fewer than 150 natural or legal persons per EU member state;

- an offer of crypto-assets solely addressed to qualified investors;

- for 12 months the total consideration of an offer to the public of crypto-assets in the EU does not exceed 1,000,000 euros.

Quickly select a jurisdiction and register your company anywhere in the world online

Issuers of asset-referenced tokens

To become an issuer of asset-referenced tokens (ART) legal person or other undertakings shall be authorized under the MiCA or as a credit institution. The rule above shall not apply when 12 months the average outstanding value of all ART never exceeds 5,000,000 euros or the offer to the public of the ART is solely addressed to qualified investors. Issuers of ART are also obliged to establish white papers with the resemblant content as mentioned above. Marketing communication requirements for issuers of ART are also similar.

Issuers of ART shall (among other things):

- Act honestly, fairly, and professionally.

- Communicate with the holders and potential holders of ART in a fair, clear, and not misleading manner.

- Maintain and operate an effective policy to prevent conflicts of interest.

- Notify their competent authority of any changes to their management body.

- Constitute and maintain a reserve of assets insulated from other assets which shall be held in custody by a third party.

- Have own funds equal to 350,000 euros or 2% of the average amount of the reserve assets (the higher indicator is taken into account).

- Grant ART holders redemption rights at all times on the issuer of asset-referenced tokens, and on the reserve assets.

- Ensure good repute, and possess knowledge, experience, and skills of the management body’s members.

- Establish and maintain effective procedures for the handling of complaints.

- Establish a business continuity plan.

- Have internal control mechanisms and effective procedures for risk management.

- Establish, maintain and implement policies and procedures on the reserve of assets, the custody of the reserve assets, the mechanism through which asset-referenced tokens are issued, the protocols for validating transactions in ART, the mechanisms to ensure the liquidity of ART, etc.

For ART with a value issued higher than EUR 100 million, the issuer shall report quarterly to the competent authority, for each asset-referenced token:

- the customer base;

- the value of the asset-referenced token issued and the size of the reserve of assets;

- the average number and value of transactions per day;

- an estimation of the average number and value of transactions per day associated with uses as means of exchange within a single currency area.

When, for a given ART, the estimated quarterly average number and value of transactions per day associated with uses as means of exchange is higher than 1,000,000 transactions and 200 million euros respectively, within a single currency area, the issuer shall:

- stop issuing the asset-referenced token;

- present a plan to the competent authority, within 40 working days, to ensure that the number and value of transactions per day associated with uses as means of exchange within a single currency area are kept below 1 000 000 and EUR 200 million respectively.

Issuers of e-money tokens

An issuer of e-money tokens (EMT) shall be certified as a credit institution or an electronic money institution, which involves obtaining an EMI license. The potential offeror of EMT shall notify its competent authority 40 working days before the date on which it intends to issue EMT. No issuer of EMT shall grant an interest concerning e-money tokens.

Before offering EMT to the public the issuer of EMT shall publish a crypto-asset white paper on its website with the resemblant content as mentioned above. The issuer of EMT shall notify its draft crypto-asset white paper to the relevant competent authority at least 20 working days before the date of its publication.

Marketing communication requirements for issuers of EMT are similar to issuers of other crypto-assets.

Other requirements for the issuers of EMT are established in Title II and III of Directive 2009/110/EC on the taking up, pursuit, and prudential supervision of the business of electronic money institutions.

Crypto-assets service providers

The following types of services are regulated under the MiCA:

- the custody and administration of crypto-assets on behalf of third parties;

- the operation of a trading platform for crypto-assets;

- the exchange of crypto-assets for funds;

- the exchange of crypto-assets for other crypto-assets;

- the execution of orders for crypto-assets on behalf of third parties;

- placing of crypto-assets;

- transfer services for crypto-assets on behalf of third parties;

- the reception and transmission of orders for crypto-assets on behalf of third parties;

- advice on crypto-assets;

- portfolio management on crypto-assets.

According to MiCA all of the CASPs shall meet such general obligations:

- To be authorized by a competent authority in an EU member state. CASP from the third country can provide crypto-asset services only at the exclusive initiative of a client based in the EU.

- Meet the requirements of the minimum share capital, which varies from 50,000 euros to 150,000 euros depending on the type of services provided by CASP.

- To have in place prudential safeguards equal to the amount of the minimum share capital requirements or one-quarter of the fixed overheads of the preceding year (the higher indicator is taken into account).

- Act honestly, fairly, and professionally in the best interest of clients.

- To safe keep clients’ crypto-assets and funds and prevent their use of them for their account.

- To ensure good repute, possess knowledge, experience, and skills of the management body’s members.

- To provide appropriate policies and procedures for including anti-money laundering (AML), continuity of services, and data security.

- Establish and maintain effective procedures for the handling of complaints.

- Maintain and operate an effective policy to prevent conflicts of interest.

- Providers of particular services shall have in place a plan that is appropriate to support an orderly wind-down of their activities without causing undue economic harm to their clients.

- At least one director of the CASP shall be resident in the EU.

Additionally, providers of the particular crypto-assets services shall comply with some specific regulatory requirements.

As an exception, the following entities can provide crypto-assets services without obtaining additional authorization by notifying competent authority at least 40 days before providing those services for the first time:

- Credit institutions – for all kinds of crypto-assets services;

- Investment firms – for crypto-assets services equivalent to the investment services accordingly to MiCA;

- Electronic money institutions – for custody and administration of crypto-assets on behalf of third parties and providing transfer services for crypto-assets on behalf of third parties concerning the e-money tokens it issues;

- Management companies of Undertakings for the Collective Investment in Transferable Securities (UCITS);

- Alternative fund managers – for the portfolio management of crypto-assets, advice on crypto-assets, and the reception and transmission of orders for crypto-assets on behalf of third parties.

Summary

It is only a matter of time before the MICA legislation comes into force. The final approval of the MiCA will provide legal assurance for crypto-assets not handled by the existing EU financial services legal framework. Establishment of the uniform rules for CASPs and issuers of crypto-assets at the EU level shall increase consumer confidence in crypto-assets by bolstering consumer protection as well as establish a foundation for the further development of the cryptocurrency market.