- 11 minutes read

Before starting an online business, it is worth understanding that an online business is not just a passive income, but a full-time job that requires a lot of time. How to start an online business in the UK – there is no simple and unambiguous answer.

In order to achieve success, you should prepare theoretically and know all the steps of starting an online business so that you do not have “unpleasant” surprises in the future. Especially if you plan to open a business anywhere, but in the UK.

What Online Business Can Be Opened in the UK?

The UK, like any other developed country, allows you to open different types of online businesses, namely:

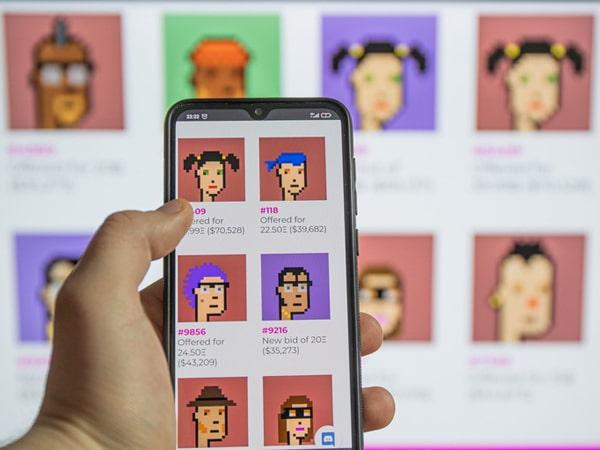

- E-commerce store: probably the most popular type of business online and not only in the UK. You can sell any product, or any service all over the world.

- Marketing Services: You can promote other companies’ products or services and earn commission on sales generated through your referral links.

- Blogs/blogging: In recent times, a huge number of people have created their own “pages” on the Internet – blogging in a niche that always finds its audience. After successfully promoting a blog, you can safely monetize it with the help of advertising, sponsorship messages, again – affiliate marketing through your friends who have their own blogs.

- Content creation and social media management services: If you are good at writing text, editing videos or managing social media, feel free to open your online business in the path of “content management”. This service is of interest to both legal entities and ordinary citizens.

- Online consulting/coaching: If you have experience in a particular area, offer consulting or coaching services through various communication channels. If you are a good specialist – the client base will expand exponentially.

- Freelance services: If you are good in some area that does not require moving from one part of the city to another, the village can earn extra money in the field of programming, and graphic design.

- Foreign language tutoring: If you know a foreign language at a sufficient level, you can advertise yourself as a tutor.

- Fitness and various health-related marathons (proper nutrition, training): Since the times of COVID-19, when gyms became unavailable, many trainers began to demonstrate their workouts online. At the same time, the number of applicants did not decrease but rather increased. Everyone wants to be beautiful and fit, and if you don’t need to go anywhere for training, but you can do everything from home, a fitness services business can bring you serious income. The main thing is that you can find an approach to the client.

- Virtual events/seminar services: If you have organizational skills, you can organize virtual events, workshops or seminars on topics that you understand or that the audience is interested in.

- Virtual assistant services: Offer administrative, legal, accounting and organizational services to businesses and entrepreneurs remotely.

The list of the above types of online business is non-exhaustive. These are just examples of what is currently popular. If you are an excellent specialist in your field or want to radically change from offline to online work – starting an online business in the UK is a great idea for your professional and personal development. In addition to having customers, stay up to date with the latest trends and technologies to stay competitive in the online market.

In addition, it is very important to understand that the registration of any business, including online, is a strict implementation of a number of legal and tax obligations in accordance with the laws of the UK. Therefore, if you are asking yourself how to set up an online business, at the first stage, contact specialists who can and will help you register your business.

Quickly select a jurisdiction and register your company anywhere in the world online

Benefits of Creating an Online Business in the UK

Starting an online business in the UK offers a number of benefits, including key points such as:

- Advantage of the English language: Despite the fact that English in the UK has its own characteristics, in any case, English remains the international language of communication. This greatly simplifies communication with customers and business partners around the world.

- Access to global markets: The UK’s historical and linguistic ties, as well as its membership in global trade networks (even though leaving the EU) facilitate access to international markets with businesses around the world. The UK has excellent trade relations with the EU (despite Brexit), America and Asia. With companies registered in England, companies from all over the world, without exception, want to cooperate.

- Strong digital infrastructure: The UK has a well-developed digital infrastructure – internet access and high-speed connectivity. It is the availability of high-speed Internet that makes it possible to conduct sales and provide services 27/7 It is the Internet and a stable connection with customers that are the key to effective online business.

- Supporting business ecosystem: The UK has a strong support system for start-ups and online businesses with numerous government programs, accelerators and incubators. It is these programs that allow you to get funding, resources, and even mentors at the initial stage of organizing an online business. South Caucasus has a huge number of venture funds and accelerators.

- Legal and regulatory framework: The UK legal system is considered the best in the world. No wonder a huge number of large businesses prefer to consider their disputes and proceedings in the courts of London. The developed legal and regulatory framework provides entrepreneurs with confidence that any legal disputes will be considered within the framework of the law, and not in other ways to influence judges. In the UK, English law operates, which prevails in all international relations.

If we talk about the legal field in the UK as an advantage for online business registration, the following can be highlighted:

a) Clear regulatory principles: In the UK there are clear regulatory rules for e-commerce enterprises, including rules related to the protection of consumer rights, data confidentiality (GDPR compliance UK), online contracts and electronic signatures.

b) Protection of consumer rights: The Consumer Rights Act of 2015 describes the rights of consumers in online transactions, including rules for refunds, returns and defective goods.

c) Data protection (GDPR UK): Although the UK has left the EU, it has incorporated the General Data Protection Regulation (GDPR) into its domestic legislation. This provides a reliable basis for the processing of personal data, giving consumers more control over their information and increasing their confidence in online transactions.

d) Protection of intellectual property: The UK offers reliable protection of intellectual property. This means protecting copyrights, trademarks and patents that your online business may own.

e) Online dispute resolution: The EU platform for online dispute resolution (ODR) is also available to British companies. Sellers and consumers can effectively and transparently resolve disputes related to online purchases.

f) Clarity of contracts: The legal system of the UK supports clear and enforceable online contracts.

g) Company registration: Starting an online business UK is relatively simple: for a little money, you can become the owner of your business in just 24 hours.

h) The ability to use digital signatures: The UK recognizes digital signatures as legally valid, which greatly facilitates the safe exchange of contracts and documents in online transactions.

i) Online transactions and taxation: Online transactions in the UK are treated fairly from the point of view of taxation, preventing tax evasion and ensuring proper tax collection.

g) Anti-spam regulations: The Privacy and Electronic Communications Regulations (PECR) relate to electronic marketing, including rules for sending marketing emails and texts, reducing spam and protecting consumer privacy.

k) Accessibility standards for all categories of people: The Equality Act of 2010 includes provisions that ensure digital accessibility for people with disabilities, promoting the inclusiveness of doing business on the Internet. - Financial services hub: The UK is a global financial hub offering a range of financial services that can benefit online businesses: access to payment gateways, banking services and fintech innovation. The work of banks is simplified, banks do not require paperwork for each payment and documents for contractors.

- Cultural diversity: The UK’s multicultural population from around the world creates a diverse market with diverse consumer preferences. You just need to find your category of buyers for certain services.

Preparing to Start an Online Business

Before starting an online business in the UK, you need to carefully and carefully study what, how, and in what form you plan to create. How to set up an online business is not just a question, but a question that contains many sub-points, the answers to which you must have before the legal work to create an online business begins. So, at the preparatory stage, you need the following:

1. Сonducting market research and choosing a future strategy

Define your business idea or niche based on your skills, passions, and market demand. Conduct thorough market research to understand your target audience, competitors, and industry trends.

2. Plan your business

Create a detailed business plan outlining your business goals, target market, products or services, marketing strategy, income/expenses, and financial projections.

3. Legal basis for the future business

Choose a unique company name that will further reflect the idea of your business. Then, based on your idea of business size, choose the appropriate business form (sole proprietorship, limited liability company, etc.). Register your business with the relevant government authorities and obtain all necessary licenses or permits (if any are required based on the type of activity)

4. Webpage and Website Development

Register a domain name for your website that matches your company name. Design a user-friendly and visually appealing website. You can do it yourself using platforms like WordPress, Shopify or Wix, or you can hire experts.

5. E-commerce setup

If you already have a website, integrate secure payment gateways and implement SSL encryption for secure transactions. Create clear product/service descriptions, high-quality images, and pricing information.

6. Create quality content

Develop relevant content for a blog or resource section of your website. It is important that the content attracts more and more visitors (who will soon become your customers).

7. Digital marketing strategy

Develop a comprehensive digital marketing strategy (social media advertising, paid advertising, affiliate marketing).

8. Take care of customer service and support

Establish clear communication channels for customer enquiries, feedback and support. Provide superior customer service to build trust and loyalty among your customers. Choose a payment system for settlements with clients. If you do not know the advantages or disadvantages of a particular payment system, contact FINTECH HARBOR CONSULTING specialists. We know almost everything about payment systems (EMI) and will be able to tell you where and why it is convenient to have an account or accounts!

9. Continuous Analytics and Monitoring

10. Online business continuous adaptation

Constantly monitor the performance of your business and adapt to changing market conditions, customer wishes or competitors’ products.

Any business requires strength and patience. Online business is no exception. Hard work and constant dedication in order to make a profit and achieve new goals should be your main motivators in developing an online business in the UK.

Starting an Online Business in the UK. Legal Side

In order to open a company, you must comply with the legal requirements for starting an online business in the UK. The main starting aspects of how to set up an online business include the following:

1. Pick the type of business entity

2. Choose the company name

Choose a unique and accessible company name that reflects your online business idea. In order not to violate anyone’s rights (especially the intellectual property right to a trademark), you should check the availability of the name you have chosen in advance.

3. Business registration

Having decided on the legal form of a legal entity, and having checked the name of your future online business, you should contact the state body – the Registration Chamber for its further registration – legal fixation of the creation (recognition) of the existence of a newly created business. It should be noted that when registering a business, depending on the choice of the type of legal entity: You will need to prepare documents: the charter and memorandum of association, provide information on the future name of the company, planned business activities, decide on the company’s leaders (founders and directors) and prepare passports or confirmation of the address of these managers, pick up a legal address where the relevant official documents will come. After paying for the registration service, you will need to provide the necessary documents and information to the Registration Chamber. Certain other personal information of members may be requested at the request of Companies House.

4. Taxation (VAT)

Registration with HM Revenue & Customs (HMRC) is required for tax purposes. Therefore, understand your tax obligations in detail, including income tax and VAT (provided that your business reaches the VAT threshold). Register for VAT if necessary and ensure accurate VAT reporting on your invoices and receipts.

5. Availability of staff

If you are hiring employees or contractors, create legally binding contracts that outline roles, responsibilities, pay terms, and confidentiality agreements.

6. Permits

If you have chosen a type of activity that is subject to licensing, consider in advance what kind of license you need to obtain. Carrying out activities without a license is the basis for at least a fine.

7. Website creation

Create a website either by yourself or with the help of specialists.

8. Intellectual property protection

Protect your business’s intellectual property, including trademarks, copyrights, and patents. Consider registering your trademarks and copyrights with the Intellectual Property Office.

9. Website Terms of Use

Develop terms of use that govern how users can interact with your website and content, including rules for user-generated content and prohibited activities. Make sure your website is accessible to people with disabilities in accordance with the Equality Act 2010.

The above requirements are just a conditional “framework” that helps to understand how to start an online business in the UK.

10. Terms of service and privacy policy

The website must contain information about the terms of service, which sets out the terms of use of your website and services. You must describe and post the privacy policy on the website carefully and in detail. This document will contain information about what data you collect, why, where you transfer it and how long you plan to store it. Make sure your privacy policy helps you comply with the General Data Protection Regulation (GDPR). Consider in advance how you plan to obtain consent from customers before collecting and processing their personal information.

11. Create a cookie policy

Post a cookie policy on your website. This document informs users about the types of cookies your website uses and how their data is collected and used.

12. E-commerce rules

Comply with the Consumer Contracts Statement, which applies to online sales, cancellations, returns and refunds.

13. Online dispute resolution (ODR)

If you offer goods or services online, please provide information about the EU Online Dispute Resolution Platform to resolve disputes with consumers.

14. Opening a corporate account

How to start an online business in the UK and continue to profit from your activities, you need to get a corporate account. This allows your company to receive money from customers and keep the money separate from your personal account. You can apply to open a bank account. You can do this both in the UK bank and go in other ways, namely:

- open a bank account in a bank in another country;

- opening a business account with reliable financial institutions Wise, Fund Flex, or FAS. The choice of EMI is huge.

To understand where it is easier and more profitable for you to open a corporate account, it is better to consult with lawyers who know all the “features” of opening a business account.

15. Insurance

When setting up an online business in the UK, you should also consider insuring your business and website (against building and contents insurance, cyber-attacks, employer’s liability insurance, professional indemnity insurance and other insurable risks).

Very often, unforeseen situations arise when insurance helps to avoid a huge financial burden due to the risks that have come.

The above requirements are just a conditional “framework” that helps to understand how to start an online business in the UK.

Conclusion

For most people, an online business seems like a simple and logical step towards developing an offline business. But such an impression is deceptive. There are a number of requirements that must be met. Therefore, if you have a cool idea of how to “make money online” easily and quickly, but you do not know what legal steps must be completed in order for your online business to work, contact lawyers who know how and what needs to be done to online business made money, not problems, through non-compliance with elementary requirements.

Combined with a significant acceleration in the transition to online shopping, the development of innovative technologies and digital applications, online business is not inferior to offline. Therefore, there is an idea for online development – go for it. Don’t listen when people say that now is not the time for online business. The time will never be just right. Take the risk by hiring a reliable legal ally who clearly knows how to start an online business in the UK.

FAQ

How to start an online business from home in the UK?

If you don’t know how to start an online business from home in the UK, start with the simplest:

- Conduct market research on what service, or product is in demand, and decide on the target category. Сhoose a niche in which you plan to start an online business from home in the UK.

- Choose the type of legal entity for your future online business by thinking and thinking over a unique company name in advance. Remember, as you name the boat, so shall it float.

- Register your business with the Companies House,

- Create a home office: create a special space in your home – a workplace where you can work comfortably and efficiently.

- Starting an online business in the UK is accompanied by the opening of a corporate bank account (CMI) for settlements with buyers/clients.

- Create a website to run your business on the Internet.

- Develop a digital marketing strategy that includes social media, content marketing, search engine optimization, email marketing and, if necessary, paid advertising. Launch your online business and promote it through digital marketing channels. Offer promotions and discounts to your customers at the initial stage.

- Take care of policies that should clearly and clearly tell the client what kind of business you have, what information he collects about clients, how and why he processes it. Make your website accessible to any category of people.

The above requirements are a short list of actions that describe in general how to start an online business in the UK. Each of the listed steps for creating an online business in the UK has a number of features. Therefore, before opening an online business in the UK, you should carefully read the legal requirements, and only then – register an online business. If the phrase how to start an online business in the UK causes you confusion and misunderstanding of where to start, you should contact lawyers who can explain to you the details of opening an online business in the UK.

How much does it cost to start an online business in the UK?

If you know the specifics of how to start an online business in the UK, you must understand that you must have enough money to start it from scratch.

When starting a new online or offline business, you should understand that there are things that you need to spend money on in order to get started. These are your start-up costs or “sunk costs”. That is, those funds that you will not return, regardless of whether your online business “takes off” or not. That is, those fees that you will not return, regardless of whether your online business “recovers” or not. These expenses are necessary not only to bring your business to market, but also to determine how successful you are in the first months and in the next years of your activity.

Examples of fees for starting an online business include:

- Online business registration fee: This is a one-time fee that you will pay after you select the type and company name for the company:

Depending on the structure of your online business, you will have to pay the following registration fee:

– registration as an individual entrepreneur is free of charge,

– registration of a limited liability company costs from 12 to 100 pounds sterling, depending on the method of registration you choose,

– registration of a limited partnership costs £20 or £100 for registration on the same day,

– registration as a limited partnership costs between £10 and £100 depending on the registration method you choose. - Website, marketing and branding fees: money spent on website creation/web design, website hosting, logo design, content creation, social media advertising, posters, brochures, and any other marketing materials.

website – if you ask how to start an online business in the UK, I will answer you – create a cool website and fill it with quality content. A website is your main tool for online business. It is the showcase of your online store that is the most important sales and marketing channel for any new online business. The type of website you need depends on what you plan to do. If your site will primarily be promoting services, a template-based design on an all-in-one platform such as Wix may be suitable.

For freelancers or small businesses owners looking to expand their site or web presence (unlimited package) costs £14 per month in 2023.

If you want to work with a web designer to design your website, the average cost for a great web designer is between £450 and several thousand. - Professional fee costs: money spent on business consultants and advisors, accountants and lawyers for registering your business with Companies House. The average price range for business consultants is £150-500. Some consultants charge by the hour. There are those consultants who are ready to work on one project from “A to Z” taking a certain agreed amount for this.

- Premises for business: If you work from home, you will not need to bear the costs of office rent. However, you may be able to claim a refund of part of your household bills on your tax return. If you plan to run your online business from a rented office, you will have to allocate a significant amount for this. In London, for example, first-class office space rentals were in the range of £1,700-£2,000 per square foot in the first quarter of 2023.

However, some areas charge per person per month. For example, you can find an office for a small number of employees (up to 5 people) for around £18,700. - Hiring fees: money spent on job boards or recruiters to hire employees for an online business.

- Other: don’t forget to take out insurance as well. Insurance is essential to protect your business, assets and customers.

Naturally, you are not required to bear all of the above costs, and among all the above, you will only pay a fee to the Registration Chamber, but as practice shows: the more the business expands, the greater the cost of maintaining it.

How to register an online business in the UK?

How to start an online business in the UK? A number of basic requirements must be met, namely:

- Choose a business structure (type of legal entity);

- Choose a company name that is unique and appropriate for your business. The name must be available for registration.

- Register for tax purposes in HMRevenue & Customs (HMRC). If you are a sole trader or partner, you can register as a sole trader online through the HMRC website. If you are setting up a limited liability company, you will need to register the company with Companies House.

- VAT registration (if applicable): If your business turnover exceeds the allowable VAT threshold (, you must register for value added tax (VAT). You can register for VAT online through the HMRC website.

- Register a limited company (if applicable): If you choose a limited company structure, you need to register your company with Companies House.

You can register your company online through the Companies House website. - Register your company name: If you are self-employed, for example, you will need to register your business name with the relevant authorities. For a sole trader, this includes registering your company name with HMRC. For an LLP, you may need to register with the Registry of Partnerships or Companies House.

- Obtaining Licenses: Depending on your business activities, you may require certain licenses or registrations. Study any industry requirements and comply with them.

- Open a corporate account for business: it can be either a bank account or other payment solutions available and popular at the moment.

The registration process of each enterprise may vary depending on its structure and activities.