These jurisdictions are selected for a good reason. Collectively, the GDP of these countries is almost half of the world’s GDP, which makes our article relevant to half of the world’s economy.

United States of America

In the United States, legislation is divided into two layers: federal and state. The definition of a stock certificate is not fixed in a single federal law for all states, as it is in many other countries.

As an example, we considered the legislation of Delaware as one of the most popular states for incorporation.

- According to Section 158 of the Delaware General Corporation Law, the stock of a corporation must be represented by certificates. However, the board of directors may declare that some or all classes of stocks may be uncertificated.

- If you own shares represented by certificates, you need to obtain a certificate signed by two officers of the corporation. If the signing officer does not fulfill that role at the time the certificate is issued, it will still be valid. The corporation cannot issue certificates in the name of the bearer only.

United Kingdom

- Section 768 in the UK’s Companies Act 2006 states that a share certificate is an initial proof of owning the specified shares. In Scotland, it’s enough to prove ownership unless shown otherwise.

- Article 129 in China’s Company Law outlines that a “Share Certificate” is an official document. It confirms the ownership of shares in a particular company.

- In addition, this provision stipulates that each share certificate issued must contain the signature of the company’s legal representative. The certificate must be sealed with the company’s official seal.

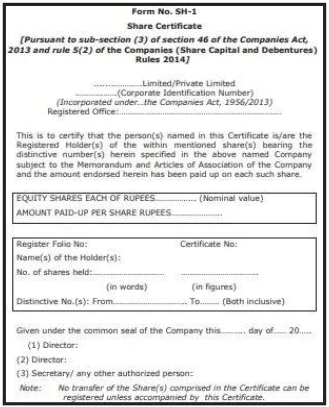

- Section 46 of India’s Companies Act specifies that a “Share Certificate,” signed by two directors or a director and the Company Secretary, serves as primary evidence of share ownership.

- The same section permits the issuance of a new certificate if the original one is proven lost. If the company fraudulently issues a duplicate, it incurs a fine at least five times the value of those shares.

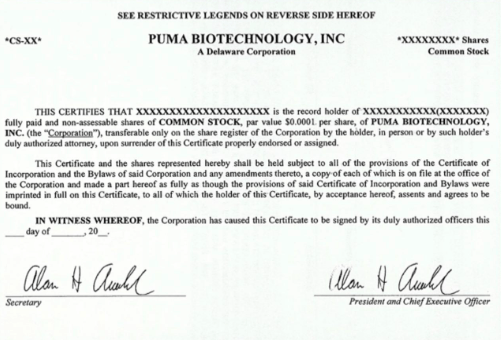

United States of America (Delaware)

In compliance with Section 151 of the Delaware General Corporation Law, information in the Stock Certificate may include:

Quickly select a jurisdiction and register your company anywhere in the world online

Information Included in a Share Certificate

- Classes and Series of Stock (§151(a)). The certificate includes the types and series of stock, along with any special rights or limitations.

- Number of Authorized Stocks (§151(b)). The certificate notes the total number of stocks authorized for each class and series.

- Voting Rights (§151(d)). The certificate defines associated voting rights.

- Company Name. The complete legal name of the Delaware corporation.

- Shareholder’s Name. Identification of the shareholder.

- Number of Shares. The number of shares owned by the shareholder.

China

- The name of the company.

- The date of the company’s incorporation.

- The class of the shares, the par value, and the number of shares represented by the certificate.

- The serial number of the share certificate.

- Share Number (§45): Each share has a unique number.

- Issuer and Seal (§46(1)): Signed by two directors or a director and the Company Secretary, it shows who owns the shares.

- Amount Paid-Up (§2 (ii), p. 237): Shows the amount that’s been paid for the shares.

- Sharing With Others (§2(iii), p. 237): If more than one person owns the same shares, only a single certificate is given.

- Company Name. The full legal name of the corporation is registered in India.

- Shareholder’s Name. Identification of the shareholder.

- Number of Shares. The number of shares owned by the shareholder.

Classes of Shares

Common Shares

Preferred Shares

Non-voting Ordinary Shares

Redeemable Shares

Bonus Shares

Electronic Share Certificates

- Corporate requirements. Review of company rules and agreements to ensure that electronic share certificates can be created. If not, corporate documents need to be amended.

- Board approval. Holding a board meeting to approve the issuance of shares in electronic or physical form. Documenting the decision in the minutes of the meeting.

- Selection of platform or software. It is necessary to select an online system designed to manage the company’s shares that allows the creation of electronic share certificates.

- Data Entry. Enter the required details into the selected platform. Generally, this is information such as shareholder name, number of shares, issuance date, and other information.

- Certificate generation. The certificate must be digitally signed or have some form of protection.

- Record keeping. Record the electronic share certificate in the company’s official shareholder register to ensure that ownership is accurately tracked.

How to Obtain a Share Certificate

- Corporate Requirements. Review the company’s rules and agreements to determine how to obtain a share certificate.

- Filing an application. Submit a formal request to the company for a share certificate. This request is generally sent to the secretary.

- Board approval (Optional). If the number of shares is large, it may require the approval of the board of directors. Documenting the decision in the minutes of the meeting.

- Verification of ownership. Once the company has received the application, it will check the applicant’s details against shareholder records to confirm that the applicant owns the relevant shares.

- Certificate production. After verification, the company will create a certificate containing essential information.

- Compliance. It is necessary to ensure that the share certificate complies with applicable laws and company rules.

- Record keeping. Record the share certificate in the company’s official shareholder register to ensure that ownership is accurately tracked.

Conclusion

FAQ

What does a share certificate look like?

A shareholder certificate is an official legal document that serves as proof of ownership of stock in a corporation. It is usually printed on high-quality security paper to prevent fraud and includes:

- Company Name. Specifies the full legal name of the registered corporation.

- Shareholder’s Name. Identifies the shareholder owning the shares.

- Number of Shares. Indicates the total shares owned by the shareholder.

- Share Type. Identifies the class and series of shares and the associated rights or restrictions.

- Unique Data. Includes serial number, issue date, and other important elements to verify ownership.

How to get a share certificate online?

General steps for obtaining an electronic share certificate include:

- Corporate requirements. Review of company rules and agreements to ensure that electronic share certificates can be created. If not, corporate documents need to be amended.

- Board approval. Holding a board meeting to approve the issuance of shares in electronic or physical form. Documenting the decision in the minutes of the meeting.

- Selection of platform or software. It is necessary to select an online system designed to manage the company’s shares that allows the creation of electronic share certificates.

- Data Entry. Enter the required details into the selected platform. Generally, this is information such as shareholder name, number of shares, issuance date, and other information.

- Certificate generation. The certificate must be digitally signed or have some form of protection.

- Record keeping. Record the electronic share certificate in the company’s official shareholder register to ensure that ownership is accurately tracked.

How to check the share certificate status?

Checking the status of a share certificate depends on whether it was issued physically or electronically. To check the status of a share certificate, it is recommended to check the official share register of the company, where the issuance of certificates is recorded. Alternatively, it is recommended to use a special online platform if the certificate was issued electronically.

How much does it cost to replace a lost share certificate?

The cost of replacing a lost share certificate may vary by jurisdiction. The cost may include administrative fees and the cost of liability insurance to protect the company against possible fraud.

- For example, under §2, p. 237 of the Indian Companies Act, the replacement of a certificate can be done for a fee of twenty rupees.

- In other jurisdictions, the cost may be considerably higher, ranging from 1%-5% of the value of share certificates.

How to obtain a share certificate?

- Corporate Requirements. Review the company’s rules and agreements to determine how to obtain a share certificate.

- Filing an application. Submit a formal request to the company for a share certificate. This request is generally sent to the secretary.

- Board approval (Optional). If the number of shares is large, it may require the approval of the board of directors. Documenting the decision in the minutes of the meeting.

- Verification of ownership. Once the company has received the application, it will check the applicant’s details against shareholder records to confirm that the applicant owns the relevant shares.

- Certificate production. After verification, the company will create a certificate containing essential information.

- Compliance. It is necessary to ensure that the share certificate complies with applicable laws and company rules.

- Record keeping. Record the share certificate in the company’s official shareholder register to ensure that ownership is accurately tracked.